Date Published: January 20, 2026

Last Updated: January 20, 2026

Each state has their own laws for tenants and landlords, so it’s important to stay aware of how your state supports tenant and landlord rights.

Millions of people in the United States have housing through rentals, like an apartment, townhouse, or condo. Through the terms laid out in the lease agreement, tenants and landlords can enforce things like habitability standards and notification requirements. While some rights are consistently found in every state’s laws, there are also major differences when it comes to specific regulations. For smaller-scale investors, landlords and other property management professionals, keeping track of all this information can be a massive headache.

Regardless, understanding your state-specific laws, rules, regulations, and protections regarding tenant rights is vital when determining how to best sell or manage your rental property. That’s where SoldFast can help.

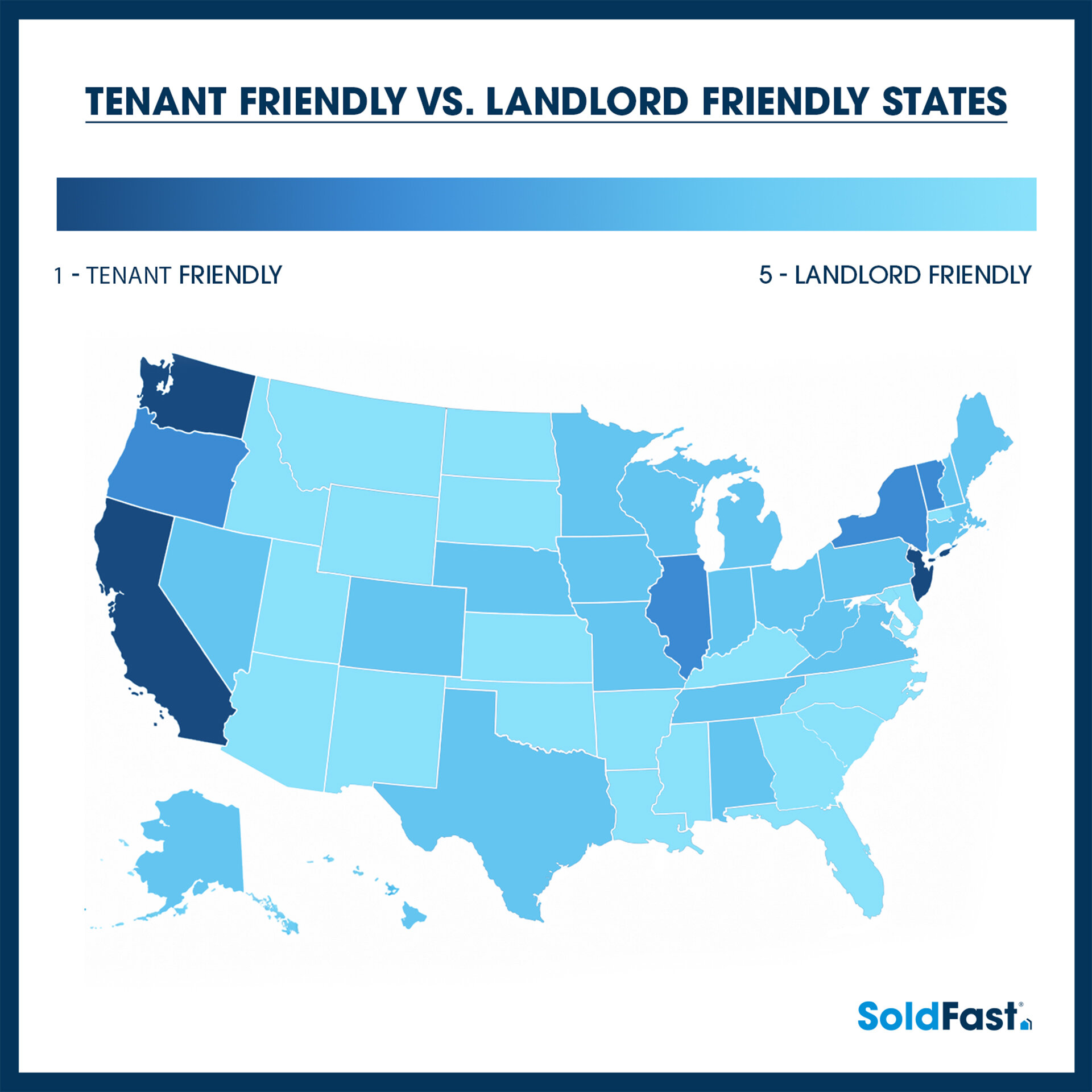

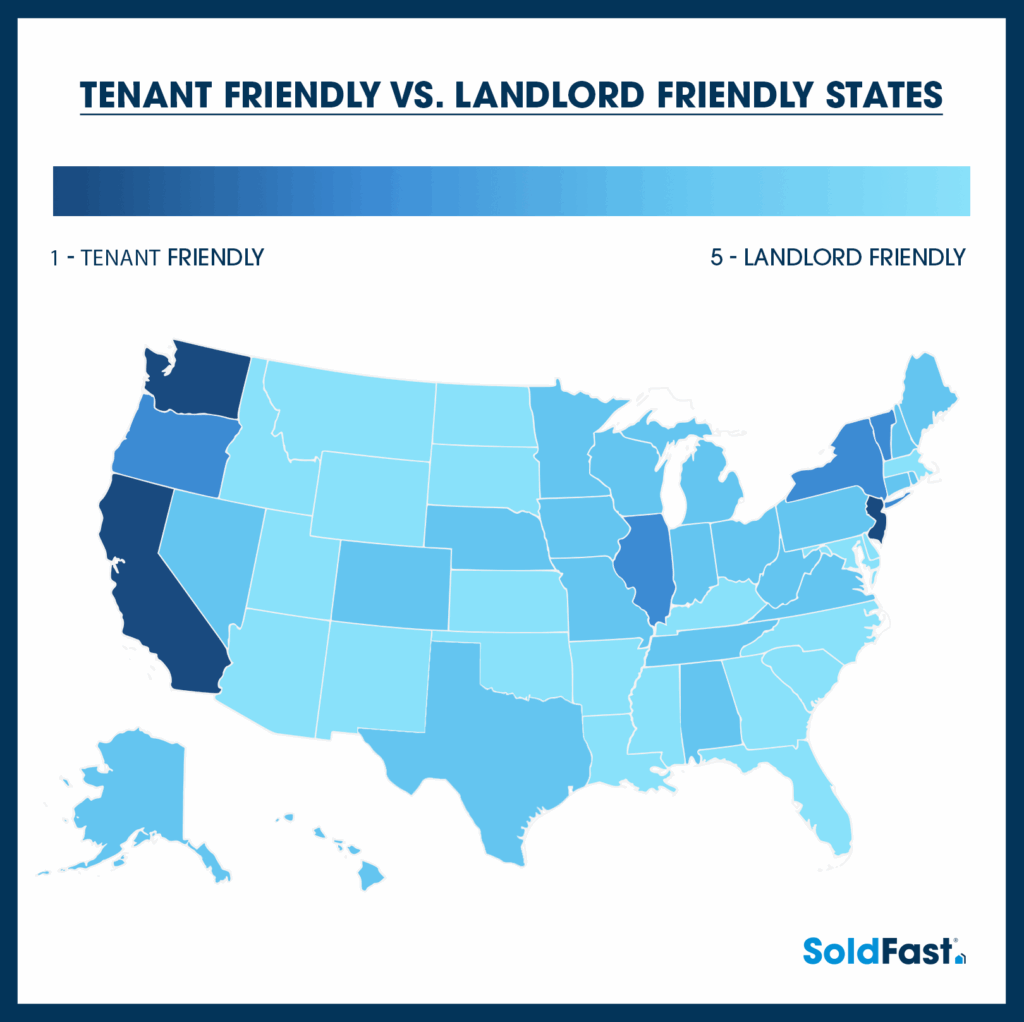

We compiled the core tenant and landlord rights for all 50 states, illustrating whether states are more tenant-friendly or landlord-friendly on a 1-5 rating system. These ratings are based on available data like effective property tax rates, eviction notice requirements and average timelines, squatter’s rights, local rent control programs and more. If you’d like more information, we have a complete guide to our methodology here.

Remember that some states will have additional regulations at the local level, usually for large metros like Chicago and New York City. We’ll include some of the most prudent examples, but it’s always a good idea to confirm any local regulations concerning rental properties before you move forward with any new investment opportunities. While we’ve done our best to draw from primary sources like state laws, this should guide be considered general information and not legal advice, especially when laws and regulations are routinely updated.

Regardless, we’re planning on keeping an eye on these stats, and making updates quarterly or when something big happens, so check back in often to see if they’ve changed! In the meantime, click the links below to find your state’s tenant and landlord rankings for 2026:

Is Alabama a Tenant or Landlord-Friendly State?

Laws: Alabama includes most of its regulations for landlords and tenants in the Uniform Residential Landlord and Tenant Act, found in Alabama Code Title 35, Chapter 9A-421 through 9A-461.

Resources: Residents can seek free legal aid through Legal Services Alabama, and the Alabama Center for Dispute Resolution offers mediation services.

Full table for Alabama

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Some tenant protections exist within the Uniform Residential Landlord and Tenant Act, but they are routine and tend to also benefit landlords when parties are following statutory guidelines (Alabama Code § 35-9A-101). | 4 |

| Rent Control or Stabilization Programs | There’s no statewide rent control program, and any local control is preempted by Alabama law, so landlords have full flexibility to set and raise prices. You can find the preemption under Alabama Code § 11-80-8.1, enacted in 1993. | 5 |

| Regulatory Burdens | There isn’t any form of statewide mandatory inspection program — which means minimal regulatory burden on landlords. Any mandated inspections are going to come from city-level programs and are usually restricted to building code enforcement. | 5 |

| Potential Eviction Costs | Filing costs are pretty high for landlords, with several counties averaging between $250-300+ to submit paperwork. Other factors like lawyer’s fees or lost rent amounts are too variable (Tenth Judicial Circuit Court of Alabama). | 3 |

| Average Eviction Rates and Timelines | 5–7 weeks is relatively slow compared to the rates you’ll find in states with similar, landlord-leaning rankings. The most recent available data for the state’s eviction rate is 3.8% in 2018 (Eviction Lab). | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | 7 business days for nonpayment or a lease violation is fairly short, but a median that’s similar to what you’ll find in other states. 30-days for month-to-month leases gives these tenants more time, but overall the process is landlord-leaning for nonpayment. | 4 |

| Approximate Effective Property Tax Rates | The average effective property tax rate is .38% but can be as high as .65% in Jefferson County, where the state’s most populous city of Birmingham is (Jefferson County Tax Administration). | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Adverse possession is earned through 20 years of continuous, hostile, open, and exclusive possession. The state only requires 10 years of possession with “color of title”, however. | 4 |

| Rules on Security Deposits | Deposits are limited to no more than 1 month’s rent; Alabama’s 60-day return window for security deposits is fair, if longer compared to other states (A.C. 35-9A-201) | 4 |

| Rules on Late Fees | No caps on late fees are imposed by law, giving flexibility to landlords for the most part. “Unreasonable” fees can be contested, however, based on things like industry standards and administrative costs (A.C. § 35-9A-421). | 3 |

Verdict: Landlord-Friendly – 4 / 5

- Favors landlord flexibility thanks to short nonpayment notice requirements, and relatively fast evictions in many counties.

- Still, Alabama has many common tenant protections like limiting deposits and holding some habitability standards.

- Cities like Birmingham have additional housing regulations for some public developments to protect their low-income residents.

Is Alaska More Tenant-Friendly or Landlord-Friendly?

Laws: Alaska’s legislation for rental properties is mostly found in Alaska Statutes Title 34, Chapter 03.

Resources: Alaska Legal Services Corporation is a non-profit providing free civil legal assistance to low-income Alaskans. They can direct tenants to resources covering security deposits, evictions, housing conditions, discrimination, and more.

Full table for Alaska

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | The state features a standardized bill of rights with the Alaska Landlord and Tenant Act and offers a state-published tenant/landlord guide specifying things like deposit rules, habitability duties, and other core obligations/rights (Alaska Statutes Title 34, Chapter 3-010 – 03.380). | 4 |

| Rent Control or Stabilization Programs | There are no rent control programs in Alaska, so landlords can set and raise their rent prices as they see fit. Anchorage has looked at providing rental assistance to tenants after eviction, but no program is currently in place. | 5 |

| Regulatory Burdens | Local inspections vary by county, focusing on code enforcement, rental registrations and habitability standards. Very common for landlord-leaning states, but there are also rules favoring tenants with deposit and late fee handling (A.S. § 34.03). | 5 |

| Potential Eviction Costs | The Alaskan Court System lists average filing fees of $150, and $250 if damages exceed $100,000. High markup for most things due to the state’s isolation adds to landlords’ potential financial burden (Alaska Court System). | 4 |

| Average Eviction Rate and Timelines | Uncontested evictions may be wrapped up within 6-8 weeks, but it’s heavily dependent on the county due to Alaska’s size. What eviction rate data is available puts the state at 2.8%, and difficult weather conditions + traveling distance can delay the process. | 3 |

| Required Notice Periods for Nonpayment/Lease Violations | The short, but average notice period of 7 days for “pay-or-quit” evictions favors landlords in most cases. Interestingly enough, lease violation notices may require shorter notice periods of as little as 5 days. In most cases, nonpayment eviction notices have the shorter notification window, not lease violations (A.S. § 34.03.220). | 4 |

| Approximate Effective Property Tax Rates | Alaska’s effective property-tax burden is low compared to many states, but highly variable depending on the region. Anchorage has a rate of 1.29%, while rural counties in the Arctic have rates as low as .29%. Not exactly common to build apartments that far north. | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Alaska allows possession after 10 years with good faith belief that the property belongs to you, or in 7 years with “color of title”. This is on the shorter end of things and may partly stem from the state’s rugged landscape. | 3 |

| Rules on Security Deposits | Deposit rules are regulated but very manageable for landlords. Deposits are capped at 2 months’ rent and must be returned within 30 days of moving out. These deposits must also be held in an interest-bearing account (A.S. § 34.03.070) | 4 |

| Rules on Late Fees | There is no statewide cap on late fees, but they must be considered “reasonable” and clearly specified within the landlord-tenant guide (A.S. § 34.03.020). | 3 |

Verdict: Somewhat Landlord-Friendly – 3.8 / 5

- Alaska offers landlords meaningful protections through a lack of rent control, short nonpayment notices, and very limited statewide inspection mandates.

- That short adverse-possession window is unusual, even among states that are solidly more tenant-friendly.

- The Anchorage Assembly has considered a mandatory relocation assistance program, which would provide 2 months’ rent for tenants required to vacate. It’s unclear if this will make it to the governor’s desk, though.

What Are the Tenant and Landlord Laws in Arizona?

Laws: You can find the laws relating to rental agreements between tenants and landlords in Arizona Regional Statutes Chapter 33.

Resources: Renters can find resources from organizations like the Arizona Tenants Advocates and Arizona Multihousing Association.

Full table for Arizona

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Arizona has a Residential Landlord & Tenant Act for both standard rentals and mobile homes. While current protections aren’t as robust as other states, an “Alternative Business Structure” program allows nonlawyers to own stake in legal firms, which could help expand access to legal justice in cases relating to rental housing. | 4 |

| Rent Control or Stabilization Programs | The state legislature took steps to preempt cities and counties from imposing local rent control on private residential housing (Arizona Revised Statutes § 33-1329 and § 33-1416). | 5 |

| Regulatory Burdens | Many common inspection and habitability mandates are enforced. As of January 2025, Arizona ended their Transaction Privilege Taxes to reduce housing costs, but properties must still be registered with County Assessors. Much of the state’s regulations focus on short-term rentals. | 4 |

| Potential Eviction Costs | Some available data includes $65 for Arizona Justice Court, or $218 at Superior Court. The typical rent for Maricopa County is around $1,700 monthly, so ~$3000 in lost rent is possible (Eviction Lab). | 4 |

| Average Eviction Rates and Timelines | With short statutory notice periods and fast court processing, a typical uncontested evictions may be complete within 2–4 weeks. | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | For nonpayment and serious violations, Arizona law requires a 5-day written notice (A.R.S. § 33-1368). 10-day notice is common for fixable issues like minor damage. | 5 |

| Approximate Effective Property Tax Rates | Arizona’s effective property-tax rate is relatively low (~0.44% effective rate), though absolute tax bills will depend on the assessed values and local levies. With surging growth, the state’s property values have continued to rise. | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Arizona adverse-possession laws generally require 10 years to recover land occupied openly/continuously (A.R.S. § 12-526). | 4 |

| Rules on Security Deposits | Statutes require landlords to provide an itemized list of damages and return tenants’ deposit money within 14 days, which is shorter than what you’ll find in other landlord-friendly states. | 3 |

| Rules on Late Fees | Caps are in place, preventing late fees from exceeding $5 per day from the due date if payment is not made by the 6th day (A.R.S. §33-1414). | 3 |

Verdict: Landlord-Friendly – 4.1 / 5

- Arizona strongly favors landlords on some core items, including state preemption of local rent control and a fairly short pay/quit notice period of 5 days compared to other states.

- But tenant protections include a short, 2-week deposit return window and statutory limits on late fee penalties.

- Evictions have gone up in Maricopa County (the state’s most populated) in recent years. Like most of the country, they spiked during Covid, but evictions in Arizona continue to climb. Eviction Lab noted that many Sunbelt states were facing increased rates.

Are Landlords or Tenants More Protected in Arkansas?

Laws: Look for the laws pertaining to landlord and tenant agreements in Arkansas Code Title 18.

Resources: Arkansas Law Help provides free civil legal assistance to low-income Arkansans relating to tenant rights, eviction processes, and other housing-related issues as well as through self-help resources and links to legal forms.

Full table for Arkansas

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | The state’s Residential Landlord-Tenant Act of 2007 provides standard protections like lease termination rules and eviction procedures, and overall giving landlords stronger rights. | 4 |

| Rent Control or Stabilization Programs | Arkansas has no statewide rent-control or rent-stabilization statute, so nothing limits how much landlords may raise rent. Recent bills have reinforced the state’s general stance (House Bill 1706). | 5 |

| Regulatory Burdens | There is no statewide rental-inspection program; inspection and code-enforcement responsibilities rest at local levels, focusing on code enforcement. Arkansas didn’t mandate habitability standards until 2021. | 5 |

| Potential Eviction Costs | Typical filing and service fees for uncontested cases are modest. Fort Smith’s District Court, for example, dictates fees between $65-80, while Circuit Court and county fees average $165 (District Court in Fort Smith). | 5 |

| Average Eviction Rates and Timelines | A lot of evictions wrap up in about 2–4 weeks, but that’s under normal circumstances without delays during court proceedings. The state generally tries to keep the process moving along, though. | 5 |

| Required Notice Periods for Nonpayment/Lease Violations | For nonpayment, landlords may give a 5-day notice to vacate before filing eviction, while lease-violation notices generally allow 14 days to cure or vacate. | 4 |

| Approximate Effective Property Tax Rates | Arkansas has generally low property-tax burdens compared to many states, with an effective rate of .53%. Along with typical housing values, holding costs are low for landlords. According to the city government, Little Rock’s rate is the highest at 1.4% as of 2025 (City of Little Rock, AR). | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Under adverse-possession rules, claimants need 7 years (with deed/color-of-title & paid taxes) for improved property or 15 years for wild/unimproved land. This is shorter than you’d think for how Arkansas handles other aspects of real estate law. | 3 |

| Rules on Security Deposits | Law limits the security deposit to no more than 2 months’ rent, and regulated landlords must itemize deductions and return the remaining deposit within 60 days after move-out (Arkansas Code §§ 18-16-304). | 4 |

| Rules on Late Fees | Arkansas does not impose a cap on late fees, so these and other charges depend on lease terms. For small-unit landlords, they don’t fall under any deposit-law regulation. 5-10% of rent is considered reasonable (A.C. §§ 18-16-411). | 3 |

Verdict: Landlord-Friendly – 4.1 / 5

- Arkansas offers landlords broad flexibility and enforces only modest regulatory constraints on deposits and inspections. There’s also a relatively low property-tax burden.

- Tenant protections exist and are usually based in procedural requirements; overall, Arkansas gives landlords more tools in usual situations.

How Tenant Friendly Is California?

Laws: California enforces laws relating to renters and landlords through Prop 13, Assembly Bill 12, and the Tenant Protection Act of 2019 (AB 1482).

Resources: As one of the more renter-friendly states, many different California counties provide free or low-cost mediation services for tenant-landlord disputes, while others also offer specific arbitration programs.

Full table for California

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | The California Tenant Protection Act (Assembly Bill 1482) mandates robust tenant protections, with statutory procedures for enforcing deposit limits & return rules, habitability standards, and even just-cause eviction (DOJ). This Act was further strengthened in 2024. | 1 |

| Rent Control or Stabilization Programs | With the passage of A.B. 1482, most long-term residential rentals are subject to rent-increase caps, with an annual increase limit ≈ CPI + 5% and often max 10%. Not to mention that many cities have additional rent-control ordinances, like San Francisco. | 1 |

| Regulatory Burdens | There is no statewide inspection program, but many cities/counties impose some form of regulation. Landlords in urban areas will face routine inspections, registration or licensing requirements, and other mandates (California Dept. of Real Estate). | 2 |

| Potential Eviction Costs | Eviction filing and service fees plus associated court costs are substantial; just some filing costs come in at $240–$385. Contested cases add attorney fees and months of lost rent, leaving some landlords trying to recover thousands of dollars. | 2 |

| Average Eviction Rates and Timelines | Under the state’s eviction laws, even uncontested evictions can take 30–45 days or more. Contested evictions often stretch to 6–10 weeks or longer, and 2025 reforms extended response-times even further. | 2 |

| Required Notice Periods for Nonpayment/Lease Violations | For nonpayment or lease violations, landlords follow statutory notice requirements of 3-day pay/cure or quit, but just-cause rules and relocation-assistance requirements mean lots of “termination without cause” evictions are effectively blocked. | 2 |

| Approximate Effective Property Tax Rates | The statewide effective property-tax rate is relatively low due to Proposition 13, with assessed value increases capped and a base tax rate ~1%. Despite this, high property values in many areas still make absolute tax bills high. | 3 |

| Adverse Possession Requirements (Squatter’s Rights) | Adverse possession requires 5 years’ continuous possession under claim of right + paid taxes, which is one of the shortest windows overall. And as you can imagine, the state’s procedural requirements for removing a squatting tenant extend the timeline (C.C.P. § 325). | 2 |

| Rules on Security Deposits | Deposits are limited to 1 month’s rent for and require itemized deductions. Returning the deposit, or remainder if there are damages, must be done within 21 days after move-out (California Department of Justice). | 2 |

| Rules on Late Fees | While late fees are allowed, they must be “reasonable”. Many landlords accept 5–10% of rent at most and the court system will scrutinize excessive fees. | 2 |

Verdict: Strongly Tenant-Friendly – 1.9 / 5

- It’s no surprise that California imposes a lot more constraints on landlords through statewide rent-control and just-cause eviction laws (thanks to AB 1482), along with local inspection requirements and one of the lengthiest eviction processes in the country.

- Additionally, cities like San Francisco feature their own rent-control ordinances or other regulations, which means another layer of complexity.

- While the property-tax structure via Proposition 13 provides some relief to landlords, overall the environment is clearly tilting in favor of renters.

Is Colorado a Tenant or Landlord-Friendly State?

Laws: Colorado Revised Statutes Title 13 covers most rental agreement laws for the state, but there are also county and city level regulations to consider, such as in Boulder and Denver.

Resources: Colorado’s Department of Housing connects renters with numerous resources, including free legal aid providers and self-help information. Additionally, premises located within the City and County of Denver must provide the Denver Tenant Rights and Resources Handbook to their tenants.

Full table for Colorado

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Colorado doesn’t have a formal Landlord & Tenant Act, so habitability, security deposit, and notice requirements are in various statutes. These protections are a bit more “reined in” than you might expect. | 3 |

| Rent Control or Stabilization Programs | Colorado preempted any sort of local rent control program, though some cities may impose extra limits. There are a few statewide rules, like capping rent on tenants’ pets (House Bill 23-1068). | 5 |

| Regulatory Burdens | Any rental property inspections are generally a local matter as well, but the state does enforce some regulatory rules like providing cause for eviction and disclosure for all fees. | 4 |

| Potential Eviction Costs | Filing and sheriff fees for uncontested eviction usually come in around a few hundred dollars. Jefferson County’s fee for the sheriff’s office is $130, and in Denver, a tenant’s answer to an eviction judgment costs $100 to file (Jefferson County Sheriff’s Office). | 3 |

| Average Eviction Rates and Timelines | There can be a decent amount of variety, with different situations wrapping up evictions between 2–8 weeks. On April 19, 2024, the state’s For Cause Eviction policy kicked in, so for no-fault evictions, landlords now need to provide 3 months’ notice (H.B. 24-1098). | 3 |

| Required Notice Periods for Nonpayment/Lease Violations | For nonpayment, landlords generally provide 10-day notices while other breaches allow 3–10 day notice periods depending on the situation. And as we mentioned above, notice must be given as much as 90 days in advance for no-fault evictions (Colorado Regional Statutes § 38-12-1303). | 3 |

| Approximate Effective Property Tax Rates | Colorado effective property tax rate is ~0.51%. In most cases, rates outside the Front Range metro will be lower. Expect the highest rates in the suburbs like Broomfield, Adams, and Douglas counties. | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Adverse possession requires 18 years of continuous & hostile use, but like a lot of states, color of title exceptions may reduce this. | 4 |

| Rules on Security Deposits | Colorado law limits deposits to 1 month of rent and requires its return or an itemized deduction within 30 days. 60 days is possible if it’s included in the lease. Also, landlords can’t use the deposit to cover “normal” wear and tear (C.R.S. § 38-12-507). | 3 |

| Rules on Late Fees | Late fees must be “reasonable” per lease, which is usually $50 or 5% of rent. Landlords need to give a 7-day notice before charging it, and a 180-day notice before its due date. | 3 |

Verdict: Somewhat Landlord-Friendly – 3.5 / 5

- Colorado favors landlords overall thanks to modest property tax rates and minimal inspection obligations.

- Eviction timelines and tenant protections are pretty balanced, and mandating the tenant rights handbook helps keep renters better informed of all their options, which is itself important when it comes to recognizing issues that may need mediation.

What Are the Tenant and Landlord Laws in Connecticut?

Laws: Connecticut houses its statutes for tenants and landlords in Connecticut General Statutes Title 47a, Chapter 830-32.

Resources: The Connecticut Judicial Branch Law Libraries provides extensive information about tenant rights and habitability standards, and served as a solid primary source for our information here. Calling 211 connects residents across the state with nearby housing resources, including rental assistance programs they can apply for.

Full table for Connecticut

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Connecticut didn’t formalize a Landlord-Tenant Act, but existing legislation still has strong statutory tenant protections, including habitability requirements, security deposit regulations, and anti-retaliation rules (Connecticut Department of Consumer Protection). | 3 |

| Rent Control or Stabilization Programs | While some cities in Connecticut historically regulated rental properties more heavily, there isn’t any statewide rent-control laws on the books right now. | 5 |

| Regulatory Burdens | Connecticut has no statewide mandatory rental-inspection program, so any inspection requirements are local (C.T.G.S. Landlord-Tenant Code). Larger cities like Hartfield and New Haven have additional rules through the Fair Rent Commissions, allowing tenants to challenge “excessive” rent hikes. | 5 |

| Potential Eviction Costs | The Connecticut Judicial Branch provides some info on fees for summary processes. In most cases they’re modest (~$80–100), and sheriff service fees add another $50-100. A range of $300-600 would be a strong estimate for average expenses in uncontested cases. | 3 |

| Average Eviction Rates and Timelines | Uncontested evictions take 4–8 weeks from notice to judgment, which is squarely in the middle of state rankings. (Connecticut Judicial Branch). | 3 |

| Required Notice Periods for Nonpayment/Lease Violations | For nonpayment, Connecticut law requires a 3-day notice to quit before filing eviction; other breaches allow 10–30 days depending on the lease type (CT Judicial Branch). | 4 |

| Approximate Effective Property Tax Rates | Connecticut has moderate to high property-tax rates, but less variation since the state itself is small and mostly urbanized; effective rates are usually around 1–2%. | 3 |

| Adverse Possession Requirements (Squatter’s Rights) | Adverse possession requires 15 years of continuous use for claiming property in Connecticut, while removal of any trespassers follows standard eviction/trespass procedures. | 4 |

| Rules on Security Deposits | Security deposits are capped at two months’ rent for unfurnished units, and must be returned with itemized deductions within 30 days after move-out (CT Department of Consumer Protection). | 3 |

| Rules on Late Fees | Late fees must be reasonable, which is often interpreted as a small percentage of monthly rent, and any excessive fees may be unenforceable (CT Judicial Branch). | 3 |

Verdict: Somewhat Landlord-Friendly – 3.6 / 5

- Connecticut provides landlords a slight edge with the flexibility here, but like a lot of New England states, higher effective property tax rates increase holding costs.

- Eviction timelines and tenant protections are pretty standard, although the notice to quit period of 3 days for nonpayment is on the shorter side, and a window you’ll mostly find in states even more landlord-friendly.

Does Delaware Offer More Protections for Landlords or Tenants?

Laws: Delaware Code Title 25 (Property – Residential Landlord-Tenant Code) Chapter 53 contains most of Delaware’s prudent laws and regulations involving landlords and their tenants.

Resources: The Delaware Code Online offers quick access to the state’s landlord and renter laws, while resources like financial aid programs are offered by the Delaware Housing Assistance Program.

Full table for Delaware

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | The state’s formal Residential Landlord-Tenant Code provides expected protections for habitability and other standards but is generally considered balanced, not favoring one party more than the other (Delaware Courts). | 4 |

| Rent Control or Stabilization Programs | Delaware has no statewide rent-control law, allowing landlords to freely set and raise rent. While there aren’t any cities that try and enforce additional programs, the state does allow low-income residents free legal representation in housing cases. | 5 |

| Regulatory Burdens | No statewide mandatory rental-inspection program exists, but local level enforcement relating to licensing and inspections is found in Wilmington (Delaware Judicial Branch). | 5 |

| Potential Eviction Costs | Total filing and service fees look pretty modest at around ~$100–$200. Justice of the Peace Court charges $45 but don’t forget that the total can vary significantly. That being said, these lower costs are most likely unless the eviction is contested (Delaware Courts). | 4 |

| Average Eviction Rates and Timelines | Eviction typically takes 2–6 weeks for uncontested cases, and the rate has gone down over the last 12 months based on data from Eviction Lab. Wilmington saw a particularly step decline in the last couple of years and now hovers around 10% (Delaware Courts). | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | For nonpayment, landlords provide a 5-day notice to pay rent or vacate. As for most lease violations, landlords generally allow 10–15 days to resolve the issue before filing (Delaware Courts). | 4 |

| Approximate Effective Property Tax Rates | Delaware’s property-tax rate is fairly low at an effective rate ~0.5–0.6%, and of course actual bills vary by county. New Castle County recently cut rates, although other taxes for the district will recoup some of those losses and keep the total rate ~.76%. | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Delaware law requires 20 years of continuous, hostile possession to claim any property, while removal is your typical standardized legal process with sheriff enforcement. | 4 |

| Rules on Security Deposits | Security deposits can’t go over 2 months of rent and must be returned with an itemized statement within 20–30 days after move-out. (Delaware Code Title 25 § 5501). | 4 |

| Rules on Late Fees | Late fees aren’t capped if the amount is specified in the lease, and like usual any listed fees must be considered reasonable according to general contract principles. | 3 |

Verdict: Landlord-Friendly — 4.1 / 5

- Delaware is ultimately a bit more landlord-leaning due to faster eviction timelines, moderate deposit/late fee rules, and comparatively low property taxes at .6%. High overall property values, however, mitigate things a bit. It should also be noted that this is an increase compared to previous years, which featured rates as low as .43%.

- Standard tenant protections exist but are balanced, maintaining an environment that’s mostly favorable environment for landlords.

- Wilmington, however, adds a number of management burdens, such as mandatory licensing and stricter inspection standards.

What Are the Landlord and Tenant Laws in Florida?

Laws: Browse Florida’s regulations for tenants and landlords within Florida Statutes Chapter 83, Part II.

Resources: Information and links to available programs relating to protecting landlord/tenant rights are available from Florida’s Department of Agriculture and Consumer Services.

Full table for Florida

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Florida’s Residential Landlord and Tenant Act provides all the standard tenant protections: habitability standards, deposit return windows, and the eviction procedures. In general, these laws favor landlords. | 4 |

| Rent Control or Stabilization Programs | Florida passed House Bill 1417 in 2023, preempting local rent control programs and overriding tenant protections with state-sponsored rules. The state’s “Live Local Act” or Senate Bill 102, also works to restrict local measures. | 5 |

| Regulatory Burdens | Minimal regulations are placed on landlords. In fact, Florida is trying to address its housing crisis through landlord/developer incentives like laxed zoning laws or tax breaks when the required percentage of housing is affordable (S.B. 102). | 5 |

| Potential Eviction Costs | The Florida court system offers some example filing fees that hover around ~$185, while sheriff services average between $50-75 (Florida Courts). | 4 |

| Average Eviction Rates and Timelines | Florida evictions for either nonpayment or lease violations typically take 2-6 weeks to complete if they’re uncontested. Eviction Lab’s tracked evictions in Florida cities show positive signs: rates are down across most metros except Jacksonville and Gainesville at 0% and 2% respectively (Eviction Lab). | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | Landlords must provide a 3-day notice to pay or vacate for nonpayment, and a 7-day notice for noncompliance with lease terms. The 3-day notice for nonpayment is very common in landlord-friendly states (Florida Statutes § 83-56). | 5 |

| Approximate Effective Property Tax Rates | We find the rare use of a statutory cap here, in the form of a 10% Non-Homestead Cap that limits property value increases to 10% of assessed value each year. As a whole Florida has relatively low effective property-tax rates compared with many states, with an average between .89% and .99% (Property Appraiser of Miami-Dade County). | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Adverse possession requires 7 years of continuous possession with claim of ownership and taxes paid. The period of time goes up to 10 years if you can’t produce color of title. Standard eviction laws follow the procedures found in plenty of other states. | 4 |

| Rules on Security Deposits | Security deposits have no statutory cap, but landlords need to return them or provide an itemized list of deductions within 15-60 days depending on lease terms. (Florida Statutes § 83-49). | 4 |

| Rules on Late Fees | Late fees must be reasonable and clearly specified in the lease and Florida law generally interprets that as $20 or 5% of monthly rent (Florida Statutes § 83-56). | 4 |

Verdict: Strongly Landlord-Friendly — 4.3 / 5

- Florida is one of the more landlord-favorable states due to fast evictions, short notice periods, modest property taxes, and no cap on security deposits.

- Tenant protections exist but are standard.

- Rising insurance costs along coastal areas are one of the more unique aspects of the state’s overall risks for property investors and managers, with stronger and more frequent storms impacting many of the state’s most popular communities.

What Are the Landlord and Tenant Laws in Georgia?

Laws: Georgia laws pertaining to property rental rights and responsibilities are found in Georgia Code Title 44, Chapter 7.

Resources: The Georgia Department of Community Affairs can provide information about landlord requirements and tenant protections. The DCA used to provide a rent and utility assistance program but sunsetted it as of September 30, 2025.

Full table for Georgia

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Georgia law provides basic tenant protections such as habitability, security deposits, and eviction procedures, but overall favors landlords. The recent House Bill 404 introduced new protections like security deposit caps. | 4 |

| Rent Control or Stabilization Programs | No programs are in place, and the state legislature preempted any control at the city/county level. | 5 |

| Regulatory Burdens | Known as Georgia’s “Safe at Home Act”, H.B. 404’s standards and caps placed some new burdens on landlords to meet these requirements. That being said, Georgia is one of the last states to establish things like habitability standards. This state still firmly favors landlords. | 4 |

| Potential Eviction Costs | According to Georgia Legal Aid, many state filing fees total somewhere between $100–120. One example is $60 from the Magistrate Court of Fulton County and does not include service fees or cases with additional defendants (Official Code of Georgia Annotated § 15-10-80 and § 36-15-9). | 4 |

| Average Eviction Rates and Timelines | Depending on the situation, evictions in Georgia can be expected to wrap up within 3-6 weeks, and likely on the shorter end for uncontested cases. | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | For nonpayment of rent, Georgia requires the shorter 3-day notice to pay or quit, while for other lease violations, the notice window depends on lease terms. The usual violations allow 7–10 days to cure (O.C.G.A. § 44-7-50). | 5 |

| Approximate Effective Property Tax Rates | Georgia has moderate property-tax rates between .77% and .83% of assessed value. If you’re more than 120 days late with payment, a 5% penalty is added, with subsequent increases every additional 120 days to a maximum of 20% (O.C.G.A. § 48-2-40-44). | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Adverse possession will require 20 years of continuous possession, but Georgia allows a surprising jump down to just 7 years with color of title. This is in hope that most applicable cases involve the “squatter” acting more like a good-faith owner. | 4 |

| Rules on Security Deposits | Security deposits are limited to one month’s rent unless the lease agreement states otherwise; regardless of the amount, deposits must be returned within 30 days including any itemized deductions for damages (O.C.G.A. § 44-7-30 to § 44-7-37). | 4 |

| Rules on Late Fees | Very common statutes here; late fees aren’t capped and are expected to be reasonable to avoid being contested (O.C.G.A. § 10-4-217). | 4 |

Verdict: Strongly Landlord-Friendly — 4.3 / 5

- Like most landlord-leaning states, Georgia preempts local rent control and offers quicker eviction timelines and low property taxes.

- Solid tenant protections exist, and in fact got stronger between 2024 and 2025 in response to the state’s growing population and symbolic resolutions championed in Atlanta. There are now habitability standards, although other changes benefit landlords, such as how notification windows have been increased for nonpayment and lease violations.

Is Hawaii Better for Tenants or Landlords?

Laws: The Residential Landlord-Tenant Code is found in Hawaii Revised Statutes Chapter 521, and is available online from the Department of Commerce and Consumer Affairs.

Resources: Landlord-Tenant Information Center at (808) 586-2634, and organizations like Maui Mediation Services can provide assistance to tenants. The Hawaii Public Housing Authority offers housing vouchers.

Full table for Hawaii

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | The state’s Residential Landlord-Tenant Code, under Hawaii Revised Statutes Chapter 521, sets most of the common protections on habitability standards, disclosures, and deposit return rules (Hawaii Department of Commerce and Consumer Affairs). | 3 |

| Rent Control or Stabilization Programs | Hawaii doesn’t enforce any statewide rent control program, although there may be temporary exceptions. For example, in the past rents were frozen on the island of Maui while disaster relief efforts were underway. | 5 |

| Regulatory Burdens | While long-term rentals are under standard protections, Hawaii is particularly restrictive with short-term rentals, establishing minimum stays of 90 days for property outside resort zones in 2025. This reflects the state’s growing concerns about the housing shortage. | 4 |

| Potential Eviction Costs | Per the state’s landlord-tenant code, filing costs include $120 for submission to District Court as well as a $10 surcharge. This doesn’t include sheriff’s fees and the steep cost of lost rent (Hawaii D.C.C.A). | 3 |

| Average Eviction Rates and Timelines | The standard eviction process in Hawaii, from serving the notice, filing a complaint, court hearings etc., takes about 4–8 weeks for uncontested cases. A high cost of living and travel expenses can make rehousing particularly costly for tenants. | 3 |

| Required Notice Periods for Nonpayment/Lease Violations | Landlords may issue a 5-day notice to pay or vacate for unpaid rent, while lease violations have a 10-day notice to cure or vacate in most cases. This is very boilerplate (H.R.S. § 521-68). | 4 |

| Approximate Effective Property Tax Rates | Hawaii’s property-tax burden is much higher than many states due to higher assessed values and cost of living; effective property tax rates vary significantly by island, let alone county. | 2 |

| Adverse Possession Requirements (Squatter’s Rights) | Standard eviction and trespass laws apply , while adverse possession is possible but requires long-term continuous occupancy of 20 years (H.R.S. § 657-31 to 657-35). This can go down to 5 or 7 years in cases w/ color of title and taxes paid (H.R.S. § 893-26 to 27). | 4 |

| Rules on Security Deposits | Security deposits are capped at 1 month’s rent, with a separate pet deposit if applicable. Deposits must be returned with itemized deductions within 14 days. | 4 |

| Rules on Late Fees | Late fees are permitted with a cap of 8% of rent under the H.R.S. 521 statutes. If you have the tenant handbook, you can find the information in Section 21(f). | 3 |

Verdict: Somewhat Landlord-Friendly — 3.5 / 5

- Hawaii tends to offer landlords more flexibility: no rent-control, manageable deposit laws, and a defined eviction process.

- However, relatively high property taxes/values and added legal complexity (longer eviction processing, late-fee caps) place regulatory burdens on property managers, especially with scale.

- With severely limited space for housing, Hawaii is paying more attention to rental laws, especially short-term rentals like those through AirBnB.

What Rights Do Tenants and Landlords Have in Idaho?

Laws: Idaho Code Title 55, Chapters 3 and 20 have most of the landlord/tenant laws, while Title 6 grants tenants the right to sue for failure to maintain essential services.

Resources: Idaho Housing & Finance Association can provide rental assistance and housing vouchers, while CATCH Idaho connects landlords with potential tenants and mediation resources.

Full table for Idaho

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Idaho offers standard tenant protections via its landlord–tenant code but lacks many of the stronger enforcement tools seen in tenant-friendly states. A lot of this will be procedural, which usually benefits landlords at scale. | 3 |

| Rent Control or Stabilization Programs | Landlords are free to set and raise rent when they want, and any local or municipal rent control laws are preempted (Idaho Code § 55-307). The state legislature restricted local control even further in 2025 with House Bill 545, ending Boise’s ordinance on Section 8 housing. | 5 |

| Regulatory Burdens | While the state only enforces commonplace procedural rules for landlords, Boise attempts to take regulations further by limiting application fees and stopping landlords from retaliating to repair requests (City of Boise). | 5 |

| Potential Eviction Costs | $166 for eviction cases is the common filing fee. Service of process documents add $10-100, and tenants wanting to respond have a fee of $136. Filing at District Court is $221. | 4 |

| Average Eviction Rates and Timelines | While a typical eviction takes about 4–8 weeks, some landlords report complete evictions in nonpayment cases in as little as 2–3 weeks. A lot of the variance comes from differing notice periods (I.C. § 6-310). | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | For unpaid rent or lease breaches, landlords can serve their 3-day pay/cure or quit notice before filing eviction, which is a very short window overall (I.C. § 6-303). | 4 |

| Approximate Effective Property Tax Rates | Idaho’s effective rate is on the lower end, with the average of .48% benefitting landlords with lots of holding costs. Within Ada County, Boise’s rate is at .64% in 2025, and the state’s highest of .84% is in Pocatello, of Bannock County. | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Adverse possession claims require a long-term occupancy of 20 years under pretty strict conditions. Color of title and property taxes can bring that down to 5 years, if the possessor is also improving on it (I.C. § 5-210). | 4 |

| Rules on Security Deposits | Idaho doesn’t cap security deposits, so landlords can charge any amount as long as it’s in the lease. On move-out, returning the deposit or an itemized deduction must be done within 21 days, or up to 30 days if the lease provides them. | 4 |

| Rules on Late Fees | No caps are enforced statewide. Idaho really only covers basic rules regarding lease terms (I.C. 55-314). When establishing late fees, some companies use flat rates while others rely on a percentage of rent. | 4 |

Verdict: Landlord-Friendly — 4.1 / 5

- Idaho offers landlords the bulk of advantages: short eviction-notice periods and flexible deposit and late-fee return windows. The late fee cap of 10% is also higher than most other states that list a specific percentage.

- Tenant protections exist but are more limited; most are establishing the routine procedures for landlords following a statutory process.

Do Tenants Have More Rights Than Landlords in Illinois?

Laws: 765 Illinois Compiled Statutes 705 Is the state’s formal Landlord and Tenant Act. For Chicago and its often-stricter rules, there’s the Chicago Residential Landlord & Tenant Ordinance (RLTO).

Resources: Resources and information about landlord and tenant rights and laws is available from the Illinois Attorney General’s office.

Full table for Illinois

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Illinois statutes provide a number of solid tenant protections, and Chicago’s RLTO (Residential Landlord & Tenant Ordinance) adds significant local protections like repair remedies, disclosure requirements and even mandating just-cause evictions. | 2 |

| Rent Control or Stabilization Programs | Illinois prohibits local rent control under the Rent Control Preemption Act, likely as a response to Chicago seeking stronger tenant laws (50 I.L.C.S. § 825). Despite this, there are bills like H.B. 255 attempting to repeal the preemption. | 5 |

| Regulatory Burdens | Newer protections in recent laws limit excessive fees and increase notice windows, adding to the administrative requirements for landlords (House Bills 4206 & 4926). There are also local rules, such as Cook County mandating inspections and registration. | 3 |

| Potential Eviction Costs | Cook County filing fee is $204, while sheriff service is ~$60 per service. A typical uncontested filing + service will cost landlords a higher rate than average of $260–$300 (Cook County Clerk of the Circuit Court). Remember, this doesn’t include lawyer’s fees and lost rent if the eviction is contested. | 3 |

| Average Eviction Rates and Timelines | Typical uncontested evictions take about 3–8 weeks from notice to writ enforcement, but timelines vary by county, so Cook, DuPage, and Lake counties will be on the upper end. | 3 |

| Required Notice Periods for Nonpayment/Lease Violations | A written 10-day notice to quit is the baseline for terminating tenancy due to a violation, while Chicago’s RLTO is actually shorter, with 5 days to pay after a written demand (735 I.L.C.S. § 5-9-210). The city also has much stricter requirements for “no cause” evictions, with as much as 4 months’ notice for long-term tenancies. | 3 |

| Approximate Effective Property Tax Rates | Illinois’ effective property tax rate is one of the highest in the country at 1.83%, largely due to Chicagoland. Rates will be lower outside the metro area, while the effective rates found in core Cook County may be even higher. | 1 |

| Adverse Possession Requirements (Squatter’s Rights) | Illinois requires 20 years to transfer land in most cases, but there are 7-year routes when a possessor has color of title and pays taxes (735 I.L.C.S. § 5-13-101 and § 5-13-109). Recent legislation, a so-called “squatter bill”, aimed to speed up removal of unlawful occupants. | 3 |

| Rules on Security Deposits | Mandated return windows are 30 days statewide and 45 in Chicago, and more protections came into effect in January 2024 with the Illinois Security Deposit Return Act (765 I.L.C.S. § 710). If deposits are held for more than 6 months, interest must be paid. | 3 |

| Rules on Late Fees | Late fees are considered liquidated damages by the state, so they must cover actual costs, and $20 or 20% rent is the cap (770 ILCS § 95-7.10). In Chicago, rules include $10 for the first $500 in rent, and 5% after. | 3 |

Verdict: Somewhat Tenant Friendly – 2.8 / 5

- Statewide, landlords face high property taxes (some of the highest in the country at 2.26%) and some strong tenant protections, with Chicago adding extra tenant protections and inspection/registration complexity.

- Chicago’s RLTO in particular adds several meaningful protections and caps (late-fee caps, disclosure rules), deposit-return timeframes commonly 45 days in major areas, and local inspection/registration programs are growing.

Landlord-Friendly or Tenant-Friendly: Which Is Indiana?

Laws: Lawmakers house Indiana’s rental property regulations within Indiana Code Title 32 (Property) – Article 31.

Resources: Tenants can access resources like free legal information or mediation services through organizations like Indiana Legal Services and Indiana Housing Now.

Full table for Indiana

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Indiana provides a standard remedies to tenants, although it lacks a statewide tenant “Bill of Rights”. Added regulations are found in some cities like Indianapolis, but local authority is limited to things like building code enforcement. | 3 |

| Rent Control or Stabilization Programs | Like most landlord-leaning states, the law prohibits counties/municipalities from adopting any rent-control measures (Indiana Code § 36-1-24.2-1 & 2). | 5 |

| Regulatory Burdens | Many Indiana cities & counties run local level programs, like mandatory registration and inspections in Bloomington. Other regulations are mostly procedural. | 4 |

| Potential Eviction Costs | Some eviction filing fees we found include Marion County’s $185 (eviction only or eviction with back rent ≤ $2,500) + $17 per adult tenant for summons prep. Sheriff service is $40 per adult tenant, so you could see $225–$300 out-of-pocket for filing (Marion County Clerk). | 4 |

| Average Eviction Rates and Timelines | Typical uncontested evictions usually complete in about 3–8 weeks. Eviction Lab estimates an average rent around $1050, so total costs reaching $2500 or more is possible. The state has a 9% eviction rate, and total filings have gone down in recent years (Eviction Lab). | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | Nonpayment clauses are enforced with 10 days notice to pay or vacate (Ind Code § 32-31-1-6 & 7). For lease violations, the landlord must give a “reasonable” cure period, although the statute itself doesn’t lay out exact timelines before filing (Ind. Code § 32-31-7-7). | 4 |

| Approximate Effective Property Tax Rates | Statewide effective property tax rates hover around .75%, with Indianapolis at .92%. Indiana sets unique caps that limit property taxes to 1% for owner-occupied homes, 2% for other residential/farmland, and 3% for commercial properties (Department of Government Finance). | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | 10 years of continuous open/hostile possession is needed to establish title (Ind. Code § 32-21-7-1). There are also the common exceptions under narrower conditions, like certain color-of-title or foreclosure rules. | 4 |

| Rules on Security Deposits | Landlords may charge any amount stated in lease, but they must return the deposit or deduction statement within 45 days after termination (Ind. Code § 32-31-3-12). | 4 |

| Rules on Late Fees | Late fees must be enforceable under the lease terms agreed upon, which is largely the only way these fees are regulated in the state. For example, there’s no mandated grace period so you may get charged a late fee 1 day after rent is due, as long as that’s in the lease. | 4 |

Verdict: Somewhat Landlord-Friendly – 3.8 / 5

- Indiana gives landlords a number of advantages, like a short, 10-day nonpayment cure notice. At the same time there’s a longer, 45-day window for returning security deposits.

- Indiana also offers a moderate effective property-tax rate at ~0.83%, which is lower than a lot of other states in the Midwest.

- Tenant protections exist, but Indiana lacks several tenant-favoring enforcement tools.

Is Iowa a More Landlord-Friendly or Tenant-Friendly State?

Laws: State lawmakers keep tenancy and rental regulations within Iowa Code Chapter 562A, their version of the Uniform Residential Landlord & Tenant Act.

Resources: Residents have access to free legal resources through organizations like Iowa Legal Aid and the Iowa State Bar Association.

Full table for Iowa

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Iowa’s Uniform Residential Landlord & Tenant Act (Ch. 562A) lays out all the standard protections: habitability, anti-retaliation, repair remedies etc. | 4 |

| Rent Control or Stabilization Programs | Iowa Code 364.3 bars cities and counties from adopting any ordinances that would limit rent prices or the rate of increases. | 5 |

| Regulatory Burdens | The state is pretty hands-off when it comes to regulatory mandates, but cities like Ames, Council Bluffs, and Des Moines have some rental-licensing and inspection fees. In Des Moines, a single-family initial inspection is ≈ $120, and duplex/triplex fees will be higher. | 3 |

| Potential Eviction Costs | You could see filing fees that include $95 for state e-file/small-claims/magistrate court. Sheriff/process service fees can be between $20–$150. The whole thing averages $300-600, but that’s only in uncontested cases. | 4 |

| Average Eviction Rates and Timelines | Evictions are fast in Iowa, ~2–5 weeks from notice to servicing in many counties, while hearings often scheduled within 7–14 days after filing. So in general, the state keeps things moving. | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | There’s the 3 days notice to pay or quit for nonpayment (Iowa Code § 562A.27(2)), while lease violations require 7 days’ notice to cure or quit (Iowa Code § 562A.27(1)). Nothing unsurprising here, and mostly in favor of landlords. | 4 |

| Approximate Effective Property Tax Rates | Effective property-tax rates are around ≈ 1.23%, which is higher than a lot of states. Long-term holding costs will be higher for landlords. | 2 |

| Adverse Possession Requirements (Squatter’s Rights) | The state requires proof of possession for at least 10 years to establish title, which can be shorted to 5 years with color of title and improvements (Iowa Code § 557.4). | 3 |

| Rules on Security Deposits | Landlords may not demand more than 2 months’ rent as a security deposit, and return them with or without damage deductions within 30 days after tenancy termination. Interestingly, landlords are allowed to keep interest during the first 5 years per the statute (Iowa Code § 562A.12(1)). | 3 |

| Rules on Late Fees | Statutory caps on residential late fees: Iowa Code limits late fees to $12/day (max $60/month) when rent ≤ $700/month, and $20/day (max $100/month) when rent > $700/month (Iowa Code 562A.9(4)). | 2 |

Verdict: Somewhat Landlord-Friendly – 3.3 / 5

- Iowa favors landlords for the most part, with faster eviction mechanics like a 3-day nonpayment notice and short overall timelines.

- Offsetting factors include those late-fee caps, a two-month security deposit cap, and a moderately high property-tax burden (~1.23%).

- A handful of localized rental-inspection programs can raise compliance costs in some cities.

- Interestingly, Iowa is one of the few states that dictate late fees on a dollar amount per day basis depending on the rent amount.

How Do Kansas Laws Affect Tenants and Landlords?

Laws: The Kansas Residential Landlord Tenant Act (KRLTA) is housed in Kansas Statutes Annotated 58-2540 to 2573.

Resources: Kansas Legal Services and the Kansas Housing Resource Corporation offers information about concerns and rights for both tenants and landlords.

Full table for Kansas

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Kansas has the basic suite of tenant protections, like restrictions on unlawful “self‑help” evictions and requiring a court order (Kansas Statutes Annotated § 58-2540 through § 58-2573). | 4 |

| Rent Control or Stabilization Programs | The state legislature preempts any form of local rent control (K.S.A. § 12-16,120). Wichita and suburbs of Kansas City are the most likely to push for future programs, but they’re unlikely in general. | 5 |

| Regulatory Burdens | Some cities on the Kansas side of the Kansas City metro have regulations concerning mandatory registration, licensing, fees, and inspections, but statewide mandates cover only basic protections. | 5 |

| Potential Eviction Costs | One law firm lists $375 for tenant removal, specifically as a flat rate attorney fee, while filing fees are mostly between $50-125 depending on the county. All in all, court paperwork fees are on the lower side, but contested cases will get expensive fast (Juris Law & Mediation). | 4 |

| Average Eviction Rates and Timelines | Evictions in Kansas can usually finish up in about 3–6 weeks for uncontested evictions due to nonpayment. Eviction Lab notes that Kansas City saw rates go up 5%, so some spillover into Kansas is likely (Eviction Lab). | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | For nonpayment of standard leases, landlords must give a 10‑day “pay or quit” notice. For lease violations, there is usually a cure‑period notice with 14 days to correct, 30 days to vacate (K.S.A. § 58-2507 to 2508). | 5 |

| Approximate Effective Property Tax Rates | The effective statewide residential property‑tax rate is around ~1.19-1.26% of home value. That’s on the higher side, and some additional levies were even instituted as recently as 2025 (K.S.A. § 76-6b01). | 3 |

| Adverse Possession Requirements (Squatter’s Rights) | Kansas formalized adverse possession laws requiring 15 years of occupation and is one of the few states that doesn’t lay out exceptions for color of title or similar variables (K.S.A. § 60-503). | 4 |

| Rules on Security Deposits | Kansas landlords can’t demand more than 1 month’s rent for unfurnished units, or 1.5 months when the unit has furniture. Deposits are returned to tenants within 14 days after determining damages, and within 30 days after the lease ends. Tenants are entitled to 1.5x of any erroneous charge (K.S.A. § 58-2550). | 3 |

| Rules on Late Fees | The state doesn’t cap late fees, but has standards for “reasonableness” to contest grossly unfair fees. Leases will need to state the fee amount and grace period. | 5 |

Verdict: Strongly Landlord‑Friendly — 4.3 / 5

- Kansas offers landlords an edge with rent setting and security‑deposit regulation as well as a pretty quick eviction process on average. There are higher property‑tax burdens, though.

- For tenants, while basic protections exist, they’re limited compared to more tenant‑friendly states.

- Kansas dictates its security deposit regulations based on whether the rental is furnished or unfurnished.

Are Kentucky Laws Friendlier to Landlords or Tenants?

Laws: Look for Kentucky’s laws and regulations concerning rental properties within Kentucky Revised Statutes Chapter 383.

Resources: Kentucky Justice is one organization that provides information to tenants about foreclosure, evictions and other housing topics.

Full table for Kentucky

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | There are basic statutory protections in the Uniform Residential Landlord Tenant Act: restrictions on self-help lockouts, habitability laws, and some notice requirements. | 3 |

| Rent Control or Stabilization Programs | Kentucky has no statewide rent control or stabilization laws, and legislation like House Bill 18 limits local authority on tenant matters (Kentucky General Assembly). Landlords are free to set rent as long as they provide written notice within the required window. | 5 |

| Regulatory Burdens | The state’s regulations are all pretty standard and based on procedural guidelines. Cities like Louisville have their own requirements, but they’re limited in scope, especially since HB 18 passed. | 5 |

| Potential Eviction Costs | We looked at court filing and sheriff’s costs in Daviess, Jefferson, & Kenton County, and typical fees are low, with a $40 filing fee for District Court and sheriff fees between $60-70 (Kentucky Rules of Civil Procedure (CR) Rule 3.03). | 4 |

| Average Eviction Rates and Timelines | The average notice periods mitigate things a bit, but in general Kentucky can complete evictions in roughly 3–6 weeks. | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | Nonpayment evictions offer 7 days’ notice, and lease violations are typically going to give you a 14-day notice to cure or vacate (Kentucky Revised Statutes § 383-500). | 4 |

| Approximate Effective Property Tax Rates | The average effective residential property tax rate in Kentucky is about 0.74%, which is in line with what you see in other southern states. The real property tax rate is reduced anytime the total of assessments exceeds the previous year’s totals by more than 4% (Kentucky Department of Revenue). | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | In order to transfer land title with adverse possession, 15 years or 7 with color of title are the most common situations to expect (K.R.S. § 413.010-413.060). | 4 |

| Rules on Security Deposits | There’s no cap on deposits, but they need to be held in interest-bearing accounts and be returned within 60 days (K.R.S. § 383-580). All in all, a very common setup for landlord-friendly states. | 4 |

| Rules on Late Fees | No caps on late fees here, although 20% is considered the unofficial upper limit for what’s reasonable. Landlords can also add costs they incurred during rent collection to any late fees (K.R.S. § 359-215). | 5 |

Verdict: Landlord‑Friendly — 4.2 / 5

- Kentucky is another state where most of the legal posture is landlord‑leaning. You’ll find state preemption of local rent control, and the lower effective property tax rates common in most southern states.

- Tenants are not completely without protection, but they’re pretty standard and come with the minimum statutory framework for things like notices and entry.

Are Louisiana’s Laws More Landlord-Friendly or Tenant-Friendly?

Laws: Rental housing laws in Louisiana can be found under LCCP Title 9 Article 4701.

Resources: Resources are offered by organizations such as Acadiana Legal Service, while the Louisiana Department of Justice and Law Library of Louisiana offer extensive information about the relevant regulations for landlords and tenants.

Full table for Louisiana

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | You’ll find standard protections but no formal act in Louisiana. The state chose not to adopt URLTA and so dictates the landlord and tenant rules in multiple different statutes and civil codes. | 4 |

| Rent Control or Stabilization Programs | There are no statewide rent control laws, and Revised Statutes 9:3258 effectively bans local control by disallowing governments from altering a lessor’s property rights. | 5 |

| Regulatory Burdens | While there aren’t many statewide mandates that aren’t commonplace, New Orleans’ Healthy Homes Program is an ordinance that requires landlord registration and inspections (City of New Orleans). | 5 |

| Potential Eviction Costs | Public info from district courts and sheriff’s offices imply average filing, court, and service fees for an uncontested eviction to be ≈ US$170, though costs still by parish. | 4 |

| Average Eviction Rates and Timelines | After filing, the process typically completes in 2–5 weeks, one of the shorter possible timelines for uncontested evictions. Due to the state’s exposure to extreme weather, tenants can’t be declared to have abandoned property for 30 days after a federally declared disaster (Civil Code Procedure Article 4731). | 5 |

| Required Notice Periods for Nonpayment/Lease Violations | The required “Notice to Vacate” is 5 days (for nonpayment or lease violation) per statute rules (City of Baton Rouge). Making the lease violation notice period the same 5 days gives landlords the edge here. | 5 |

| Approximate Effective Property Tax Rates | Louisiana’s effective property tax rate on owner-occupied housing is 0.55-.58%, one of the lowest in the country and even among southern states. | 5 |

| Adverse Possession Requirements (Squatter’s Rights) | The state’s exceptions for color of title and good faith come from civil code, protecting tenants who sincerely believe they own the land and have made improvements. Regardless, possession requires 30 years, or 10 with the exceptions listed above (C.C.P. 3473-3492). | 4 |

| Rules on Security Deposits | Under the Lessee’s Deposit Act, landlords must return security deposits or provide deductions within 1 month after terminating the lease. Other rules are dictated within the same statute (R.S. § 9:3251). | 3 |

| Rules on Late Fees | Similar to Kansas, there’s neither a fee cap nor required grace periods before charging a late fee. Everything will be dictated within the lease terms. | 5 |

Verdict: Strongly Landlord-Friendly — 4.2 / 5

- Louisiana gives landlords most of the tools here, and few statutory constraints. Landlords benefit from fast eviction processes and no caps on either late fees or security deposits (although “unreasonable” fees can still be contested).

- Louisiana also offers a low effective property tax rate at .62%, although this is a recent increase from .56%.

- The state also has one of the longest windows for adverse possession, requiring 30 years of occupancy. With color of title, however, this goes down to 10 years, which is more in line with other states.

What Are the Tenant and Landlord Laws in Maine?

Laws: Maine’s state legislature enshrined rental property laws under Title 14 Chapter 710.

Resources: Information about available resources, such as free legal advice and groups offering mediation services, has been collected by the Maine State Housing Authority for residents to use. You’ll also see services like rental housing vouchers and programs to help prevent eviction.

Full table for Maine

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Maine also didn’t adopt URLTA, but offers landlord-tenant laws under Title 14, Chapter 709 as well as statutes like § 6021. | 4 |

| Rent Control or Stabilization Programs | No statewide rent-control laws are active, but local mandates exist, like Portland’s Rent Control Ordinance. In effect on Jan 1st, 2021, it caps rent increases based on 70% of changes within the C.P.I. (Portland City Code, Chapter 6, Sec. 6-234(a)). | 3 |

| Regulatory Burdens | Statewide rules are basic, but added regulation can be found at the local level. Portland’s rent ordinance also increased notice periods, prohibits Section 8 discrimination, and even establishes a city Rent Board to mediate disputes (City of Portland) | 5 |

| Potential Eviction Costs | Maine’s Judicial Branch lists typical filing fees of around $100–$172 for uncontested FED cases plus service of process. Contested cases, however, could lead to losses between $1,000-2,000 or even more (State of Maine Judicial Branch). | 5 |

| Average Eviction Rates and Timelines | 3 to 8 weeks is a common window and may depend on the type of notice first provided. Maine’s Judicial Branch has tracked filings for the last 15 years, giving us a much more detailed understanding compared to most states. | 4 |

| Required Notice Periods for Nonpayment/Lease Violations | Statutes recognize and enforce a 7-day pay-or-quit notice for nonpayment; other causes may require longer notice, including violations of month-to-month leases (14 M.R.S. § 6002(1). | 4 |

| Approximate Effective Property Tax Rates | Effective rates are between 0.9-1% right now, which isn’t terrible, and still lower than other New England states. | 4 |

| Adverse Possession Requirements (Squatter’s Rights) | Maine treats squatting as a civil matter, so removal requires starting the eviction process. To earn adverse possession, you’ll need 20 years of continuous occupation. This is another rare instance where a state doesn’t offer exceptions for things like color of title. | 4 |

| Rules on Security Deposits | The statute caps security deposits at no more than 2 months’ rent, and landlords must return deposits within the time stated in the lease, but not to exceed 30 days (14 M.R.S. § 6032). Very common and generally balanced for both parties. | 3 |

| Rules on Late Fees | Maine law defines a payment as “late” after 15 days, capping potential late penalties at 4% of one month’s rent (14 M.R.S. § 6028). | 3 |

Verdict: Somewhat Landlord-Friendly — 3.9 / 5

- Maine has more moderate eviction costs when uncontested, and a long, two-month cap on deposits.

- At the same time, tenants benefit from a statutory 4% limit on late fees and a slightly longer eviction process compared to many other states.

- Additionally, the capital city of Portland now enforces a local rent control ordinance that limits increases and requires longer notice periods, such as 90 days for no-fault evictions. This is still impactful, but less so than you might think due to the state’s low population density. Compare this to a state like Nevada where a much larger percentage of the population (70%) lives concentrated in the Las Vegas metro.

Is it Better to Be a Landlord or Renter in Maryland?

Laws: Maryland’s Tenants Bill of Rights is found under Title 8 of the Maryland Code, and the Tenant Safety Act of 2024 added some additional protections.

Resources: The state’s new Office of Tenant and Landlord Affairs can provide education materials and dispute mediation, while the Tenants’ Right to Counsel Project from Maryland Legal Aid provides free lawyers for eviction cases.

Full table for Maryland

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Maryland requires protections such as deposit-law safeguards, interest on deposits, disclosure requirements, and a “Tenants’ Bill of Rights” within leases. In 2024, the state passed the Renters’ Rights and Stabilization Act, strengthening these protections even more. | 3 |

| Rent Control or Stabilization Programs | Some local jurisdictions have rent-stabilization ordinances, including increase caps from Montgomery and Prince George Counties (Montgomery County Office of Rent Stabilization). At a statewide level, Maryland’s Department of Housing and Community Development is taking steps like incentivizing dense housing and injecting $361 million into housing investment. | 4 |

| Regulatory Burdens | That 2024 renter’s rights act created a new Office of Tenant and Landlord Affairs to serve as a central resource. This act also now disallows landlords from evicting during extreme weather, requiring tenants to pay filing fees (outside the security deposit), and selling the property to 3rd parties without offering them to tenants first. | 4 |

| Potential Eviction Costs | Initial costs are low, with many counties listing fees of $50–$60 for evictions (District Court of Maryland). In fact, these low costs lead to high rates of filing. Some counties saw rates over 100%, meaning more evictions were filed than there were rental units in the county. Lawmakers have attempted to resolve this in recent years by raising filing costs. | 3 |

| Average Eviction Rates and Timelines | After filing, the summary ejectment and court process can take roughly 3 to 8 weeks total. Multiple sources estimate 40-60 days depending on the circumstances. | 3 |

| Required Notice Periods for Nonpayment/Lease Violations | 10-day notices for nonpayment are the norm, while lease violation notice periods vary, such as giving 14 days for a serious breach (Maryland Courts). | 3 |

| Approximate Effective Property Tax Rates | A middling rate of .90% or so in context of the surrounding states, but high property values outside D.C. can still lead to higher actual tax bills. | 3 |

| Adverse Possession Requirements (Squatter’s Rights) | The statutory period for possession is 20 years, or 10 with color of title and property taxes (MD. Code Cts. & Jud. Proc. § 5-103). Recent court cases like Carpenter v. Jenkins can illustrate just how difficult it is to assert ownership in these situations. | 4 |

| Rules on Security Deposits | Maryland law caps deposits at 2 month’s rent (or 1 depending on the lease’s configuration) and requires deposits to be placed in a separate, federally insured account. Returns must be within 45 day after tenancy ends (MD. Code, Real Property § 8-203.1). | 2 |

| Rules on Late Fees | Late fees are capped at 5% of monthly rent (Md. Code Real Property § 8-208). In October 2025, House Bill 273 clarified these rules, restricting the 5% cap to only the unpaid portion of rent. | 3 |

Verdict: Somewhat Landlord-Friendly — 3.3 / 5

- Maryland offers landlords reasonable flexibility, but for the most part its notification requirements and fee caps are lower than what you’d find in other, more landlord-friendly states.

- Also, Maryland provides meaningful procedural protections and a formal “Tenants’ Bill of Rights,” which can keep tenants informed of their rights and prevent many abuses found elsewhere.

- The Renters’ Rights and Stabilization Act impacts landlord-tenant laws in several ways, granting renters more rights and potentially tipping the state into tenant-friendly territory.

Does Massachusetts Favor Landlords or Tenants?

Laws: M.G.L. Chapters 93a & 186 cover common landlord and tenant needs such as security deposits, eviction notices, late fees etc.

Resources: Legal aid is offered via MassLegalHelp and Community Legal Aid, while landlords can receive support from MassLandlords.net (forms, helpline). There are even programs for government assistance like the Massachusetts Rental Voucher Program (MRVP) for renters.

Full table for Massachusetts

| Factor | Rationale | Score (1-5) |

|---|---|---|

| Formal Landlord/Tenant Act | Massachusetts statutes prohibit lease provisions imposing unlawful requirements (like fees for rent paid late before 30 days), while also imposing significant procedural protections. Despite this, there isn’t actually a formal landlord-tenant act, and protections are enshrined elsewhere. | 3 |

| Rent Control or Stabilization Programs | None statewide as of now, but there is a push for a 2026 ballot initiative to cap annual increases at CPI or 5%, whichever is lower. Before a 1994 referendum banned rent control, cities like Boston and Cambridge featured programs (WBUR Today: Boston’s Morning Newsletter). | 5 |

| Regulatory Burdens | There is no statewide inspection regime, so entry/inspection requirements are governed by lease terms. However, local sanitary code inspections (e.g., post-rental compliance) are common at the city level. In 2025, the state banned application fees, upfront pet fees, and broker’s fees in some cases. | 4 |

| Potential Eviction Costs | Massachusetts evictions often involve major legal costs and delays due to court backlogs. Legal practitioners report that the process can take several months and cost thousands. Attorney fees alone may be $1,500 – $4,000 or more depending on a contested case’s complexity. | 1 |

| Average Eviction Rates and Timelines | Landlords serve a 14-day notice to quit for nonpayment before filing eviction. After filing, a court hearing usually occurs 10-14 days after the summons is served. But in contested evictions, you may see overall timeline ranges as high as ~6 to 12+ weeks. Factoring in lost rent means those kinds of evictions will sting financially. | 2 |

| Required Notice Periods for Nonpayment/Lease Violations | We mentioned the 14-days’ notice to quit for nonpayment, while for other reasons like lease violations or no-fault, a 30-day or full rental-period notice is required (Massachusetts General Laws c. 186, § 12). | 3 |

| Approximate Effective Property Tax Rates | Massachusetts has a relatively high effective property tax rate compared to many states at about 0.97-1.04% of home value. With high property values at the same time, landlord costs are impacted. | 2 |

| Adverse Possession Requirements (Squatter’s Rights) | Adverse possession can be earned after 20 years with the occupation rules (open, hostile etc.). Anyone claiming possession will need to prove visible use (M.G.L. c. 260, § 21). | 4 |

| Rules on Security Deposits | Massachusetts limits security deposits to no more than 1 month’s rent, which must be placed in a separate interest-bearing account in a Massachusetts bank and returned with interest within 30 days after tenancy’s end. Requiring a bank within the state and the return of interest (it’s usually the landlord’s property) are somewhat unique among state rules (M.G.L. c. 186 § 15B). | 2 |